43 relationship between coupon rate and ytm

Malta Government Bonds - Yields Curve Normally, longer-duration interest rates are higher than short-duration. So, the yield curve normally slopes upward as duration increases. For this reason, the spread (i.e. the yield difference) between a longer and a shorter bond should be positive. If not, the yield curve can be flat or inverted. 10-Year T-Note Overview - CME Group Specs. Margins. Calendar. Among the most actively watched benchmarks in the world, the 10-Year U.S. Treasury Note futures contract offers unrivaled liquidity and capital-efficient, off-balance sheet Treasury exposure, making it an ideal tool for a variety of hedging and risk management applications, including: interest rate hedging, basis ...

Best Investment Banking Course|| By DataTrained Interest Rate and Bond Price Relation with Example; Current Yield; Yield and Bond Price; Difference between Coupon and Yield; Yield to Maturity (YTM) Difference between Coupon and Yield; Accrued Interest; Dirty Price & Clean Price; ... Get a birds-eye view of the relationship between the three financial statements and how accounting is going to ...

Relationship between coupon rate and ytm

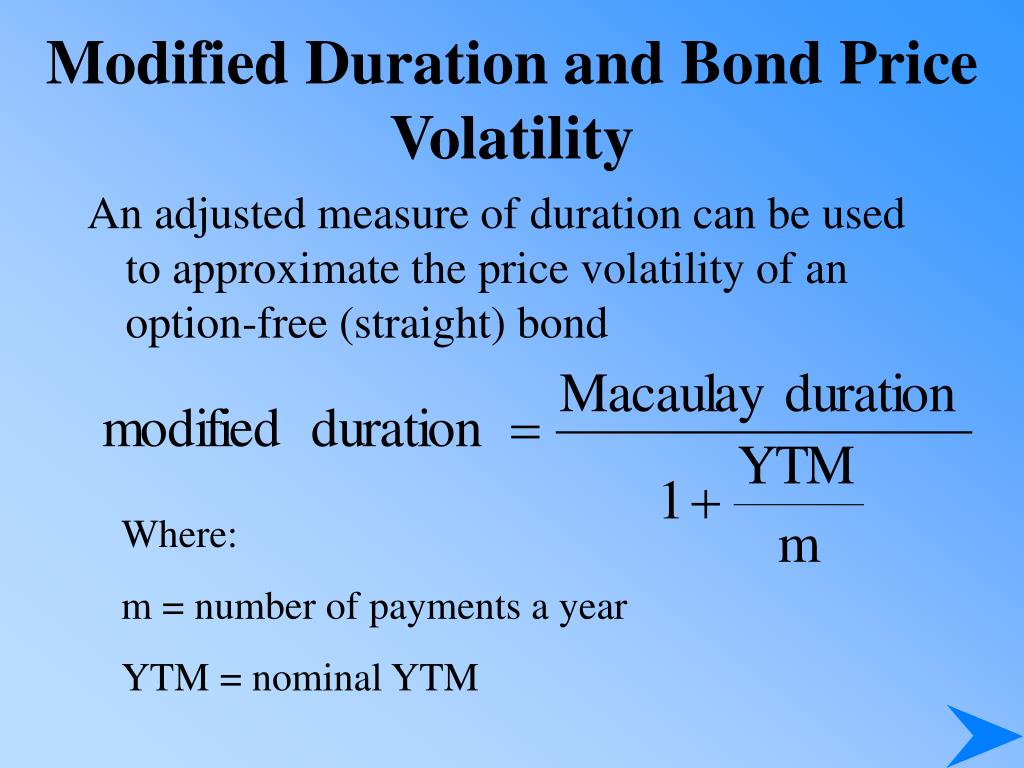

Curve Yield Spread the dispersion of individual bond yields around the coupon regression curve slightly decreased compared to last month 19, with a max profit of $81 com the cmt yield values are read from the yield curve at fixed maturities, currently 1, 2, 3 and 6 months and 1, 2, 3, 5, 7, 10, 20, and 30 years the yield curve has always been a graveyard ive just … SCHP Summary - schwab.wallst.com Duration is determined by a formula that includes coupon rates and bond maturities. Small coupons tend to increase duration, while shorter maturities and higher coupons shorten duration. The relationship between funds with different durations is straightforward: A fund with a duration of 10 years is twice as volatile as a fund with a five-year ... eFinanceManagement - FINANCIAL MANAGEMENT CONCEPTS IN LAYMAN'S TERMS Compulsory Liquidation - Meaning, Process, Benefits, and Limitation. Compulsory Liquidation: DefinitionCompulsory Liquidation, as the word suggests, is the compulsory or forceful winding up of a company. Such liquidation is thrust upon or…. Read Article.

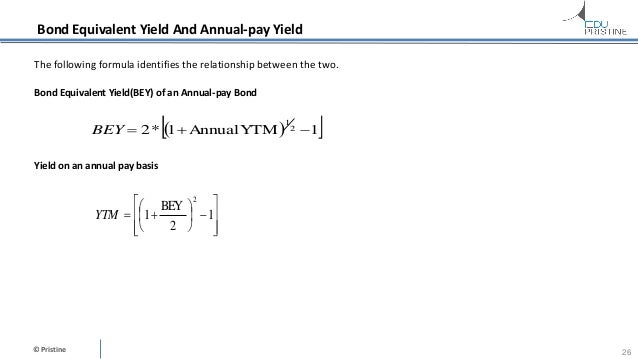

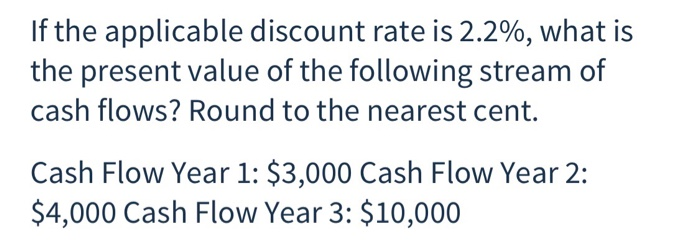

Relationship between coupon rate and ytm. LOOKING FOR A FINANCE WRITER PROFICIENT IN ACCOUNTS - Nerd Essay Writers You will need to use a coupon rate of the bond times the face value to calculate the annual coupon payment. You should subtract the maturity date from the current year to determine the time to maturity. The Web site should provide you with the yield to maturity and the current quote for the bond. A zero-coupon bond is a discounted investment that can help you save ... As of November 2020, the current yield-to-maturity rate on the PIMCO 25+ year zero-coupon bond ETF, a managed fund consisting of a variety of long-term zeros, is 1.54%. The current yield on a 20-year Treasury bond is 1.41%. It may sound small, but thanks to the miracle of compounding, it adds up — especially over time. They offer a ... Total Return Bond - Institutional Class - Guggenheim Investments Yield to maturity is the internal rate of return earned by an investor who buys the bond today at the market price, assuming that the bond will be held until maturity, and that all coupon and principal payments will be made on schedule. United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.654% yield. 10 Years vs 2 Years bond spread is -23.4 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.50% (last modification in July 2022). The United States credit rating is AA+, according to Standard & Poor's agency.

Just Eat Takeaway.com NV Stock Quote TKWY - Morningstar Our fair value estimates for Just Eat Takeaway, Delivery Hero, and Deliveroo decrease to EUR 81, EUR 88, and GBp 215 per share, from EUR 126, EUR 97 and GBp 350 per share, respectively. Just Eat ... About Corporate Bonds - NSE - National Stock Exchange India Yield is commonly measured in two ways, current yield and yield to maturity. Current yield. The current yield is the annual return on the amount paid for a bond, regardless of its maturity. If you buy a bond at par, the current yield equals its stated interest rate. Thus, the current yield on a par-value bond paying 6% is 6%. Yield to maturity 2.(a) Explain the relationship between bond price and interest rates ... Coupon payments are fixed, but the percentage return that investors receive varies based on market conditions. This percentage return is referred to as the bond's yield. Yield to maturity (YTM) is the rate of return expected from a bond held until... Posted 2 years ago Q: Why are T-Bills used when determining risk-free rates? The risk-free rate is the rate of return of an investment with no risk of loss. Most often, either the current Treasury bill, or T-bill, rate or long-term government bond yield are used as the...

2 Year Treasury Rate - YCharts Historically, the 2 year treasury yield went as low as 0.16% in the low rate environment after the Great Recession. 2 Year Treasury Rate is at 3.13%, compared to 3.03% the previous market day and 0.26% last year. This is lower than the long term average of 3.14%. Report. Market Rates Market Rates FX-Retail:The new version of FX-Retail Platform with facility to book Option Period Forward Contracts is available with effect from 28th March 2022. Click here for more information FX-Retail Promo video FX-Retail Mock (Test environment): Please click here to ... Calculator | Best Bond Calculators The relationship between bond rates and interest rates is inverse. Either of these goes up and the other's value will fall. The maturity date of the bond determines whether the investor will draw their amount of money invested plus the interest or they will invest it back to the company. There are different reasons for the issuance of bonds. Bond Python Yield Curve zero coupon curves are a building block for interest rate pricers in contrast to fixed rate bonds, floating rate bonds pay coupons which vary over their maturity bond yield-to-maturity the yield to maturity (ytm) measures the interest rate, as implied by the bond, that takes into account the present value of all the future coupon payments and the …

Unit5@19d7699432a3467690086a6dfc3c794f.pptx - Interest rate and risk ... Practice The yield to maturity on 1-year zero-coupon bonds is currently 7%; the YTM on 2-year zeros is 8%. The Treasury plans to issue a 2-year maturity coupon bond, paying coupons once per year with a coupon rate of 9%. The face value of the bond is Rs 100. a. At what price will the bond sell? b. What will the yield to maturity on the bond be? c.

SCHO Summary - schwab.wallst.com Duration is determined by a formula that includes coupon rates and bond maturities. Small coupons tend to increase duration, while shorter maturities and higher coupons shorten duration. The relationship between funds with different durations is straightforward: A fund with a duration of 10 years is twice as volatile as a fund with a five-year ...

Market and Investment Evaluation Methods - Flournoy Wealth Management ... Yield to maturity represents the return on a bond that is held until it matures. Premium: With bonds, a premium is the amount paid for a bond over and above its face With stocks, it represents the amount by which a stock's price exceeds those of comparable stocks. ... The debt-equity ratio indicates the relationship between the long-term ...

Is It Better For Bondholders When The Yield To Maturity Increases Or ... Bondholders are better off when the yield to maturity A. … increases since this represents a decrease in the bond maturity and a potential capital loss. What is the relationship between yield to maturity and interest rate?

10-Year Treasury Constant Maturity Minus 3-Month ... - St. Louis Fed Starting with the update on June 21, 2019, the Treasury bond data used in calculating interest rate spreads is obtained directly from the U.S. Treasury Department. Suggested Citation: Federal Reserve Bank of St. Louis, 10-Year Treasury Constant Maturity Minus 3-Month Treasury Constant Maturity [T10Y3M], retrieved from FRED, Federal Reserve Bank ...

The Difference Between Nominal Value and Real Value of Stock Calculating the Difference. To calculate the difference between nominal and real values, simply subtract the lesser value from the higher. The nominal value may be listed on the share or ...

Assessment Review - Corporate Finance Institute1.pdf The coupon rate is calculated by coupon divided by face value, so it must be higher than the current yield, which is coupon divided by price, since the price is higher for premium bonds. Since YTM is lower than coupon rate, the current yield, which takes the coupon more into account, is higher than YTM.Correct Answer

:max_bytes(150000):strip_icc()/BareYTMFormula-5d34698cfb7141d994781ca0fd54e332.jpg)

Post a Comment for "43 relationship between coupon rate and ytm"