39 t bill coupon rate

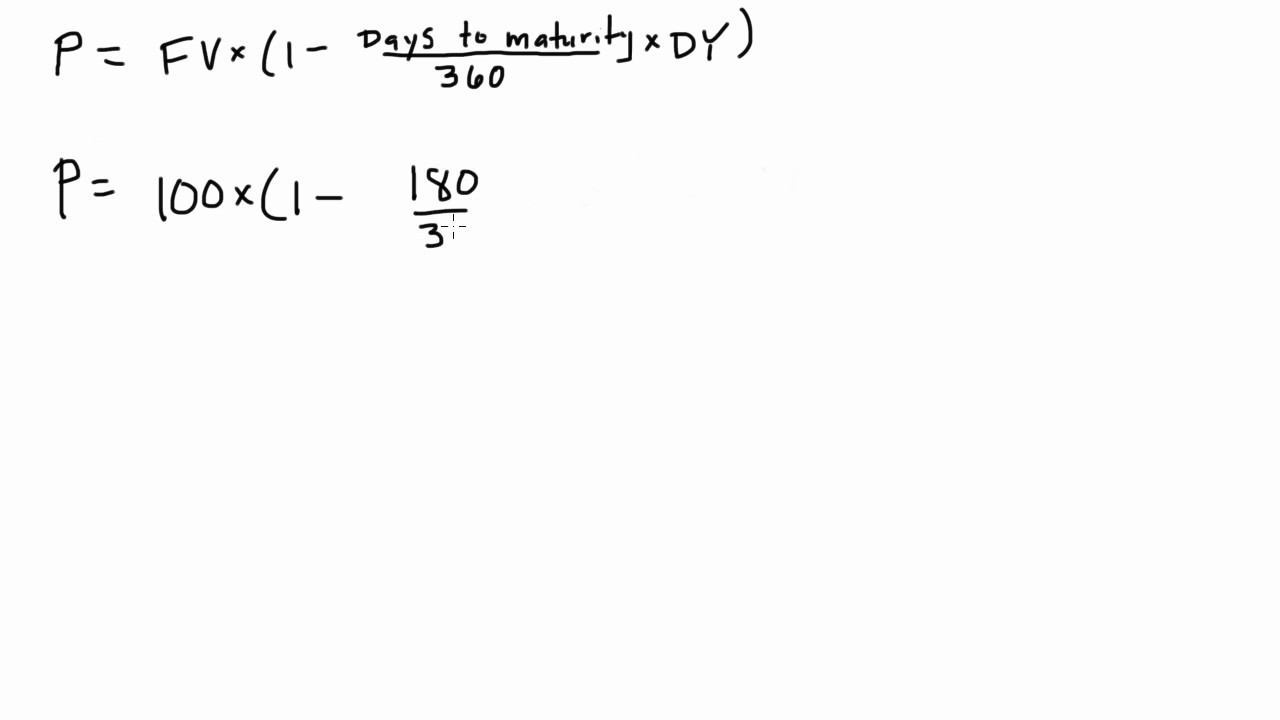

M&T Bank Promotions: Top 2 Offers for October 2022 What to Open at M&T Bank. 12-month or 24-month CD. M&T offers a great rate for their Select Promo CDs of 12-month or 24-month term. The minimum to open is $1,000. This opening deposit cannot be money already on deposit at M&T Bank. EZChoice Checking. This is M&T's free checking option. It has no monthly service fee or minimum balance requirements. Individual - Treasury Bills: Rates & Terms Treasury bills are offered in multiples of $100 and in terms ranging from a few days to 52 weeks. Price and Interest Bills are typically sold at a discount from the par amount (par amount is also called face value). The price of a bill is determined at auction. Using a single $100 investment as an example, a $100 bill may be auctioned for $98.

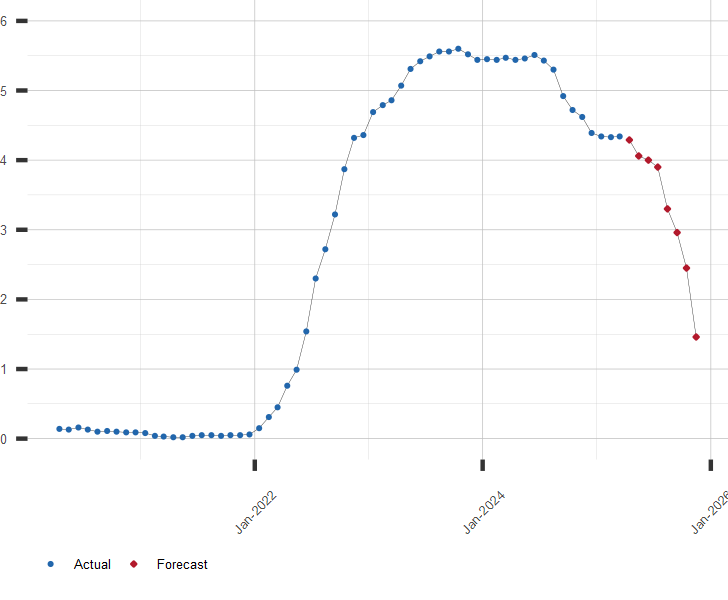

TMUBMUSD06M | U.S. 6 Month Treasury Bill Overview | MarketWatch TMUBMUSD06M | A complete U.S. 6 Month Treasury Bill bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates.

T bill coupon rate

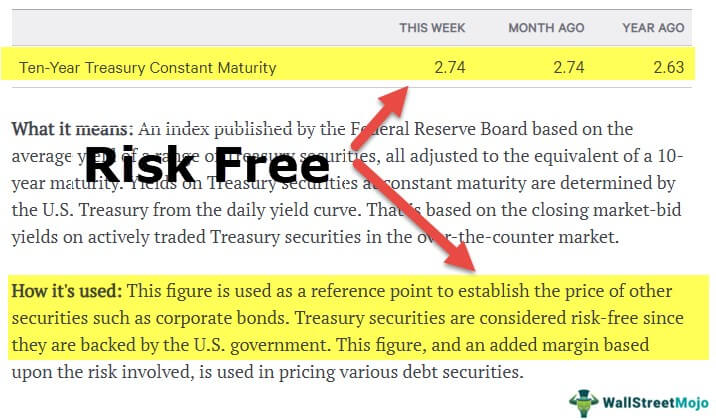

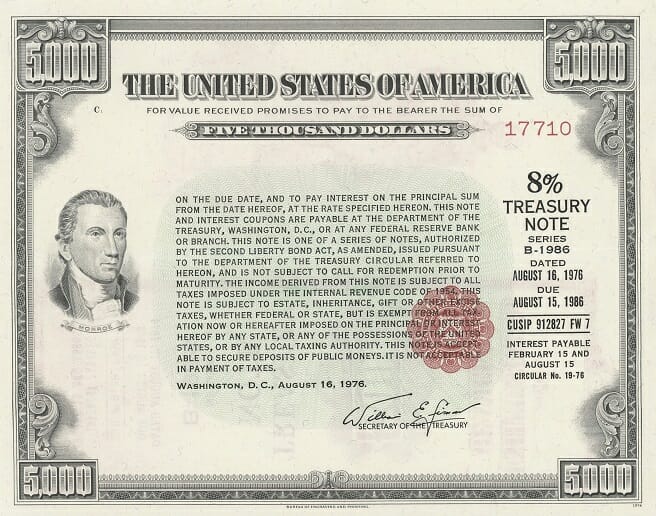

Discounting - Wikipedia Discounting is a financial mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee. Essentially, the party that owes money in the present purchases the right to delay the payment until some future date. This transaction is based on the fact that most people prefer current interest to delayed interest … 91 Day T Bill Treasury Rate - Bankrate The yield on 91-day Treasury bills is the average discount rate. How it's used: The rate is used as an index for various variable rate loans, particularly Stafford and PLUS education loans. Lenders... United States Treasury security - Wikipedia Treasury notes ( T-notes) have maturities of 2, 3, 5, 7, or 10 years, have a coupon payment every six months, and are sold in increments of $100. T-note prices are quoted on the secondary market as a percentage of the par value in thirty-seconds of a dollar. Ordinary Treasury notes pay a fixed interest rate that is set at auction.

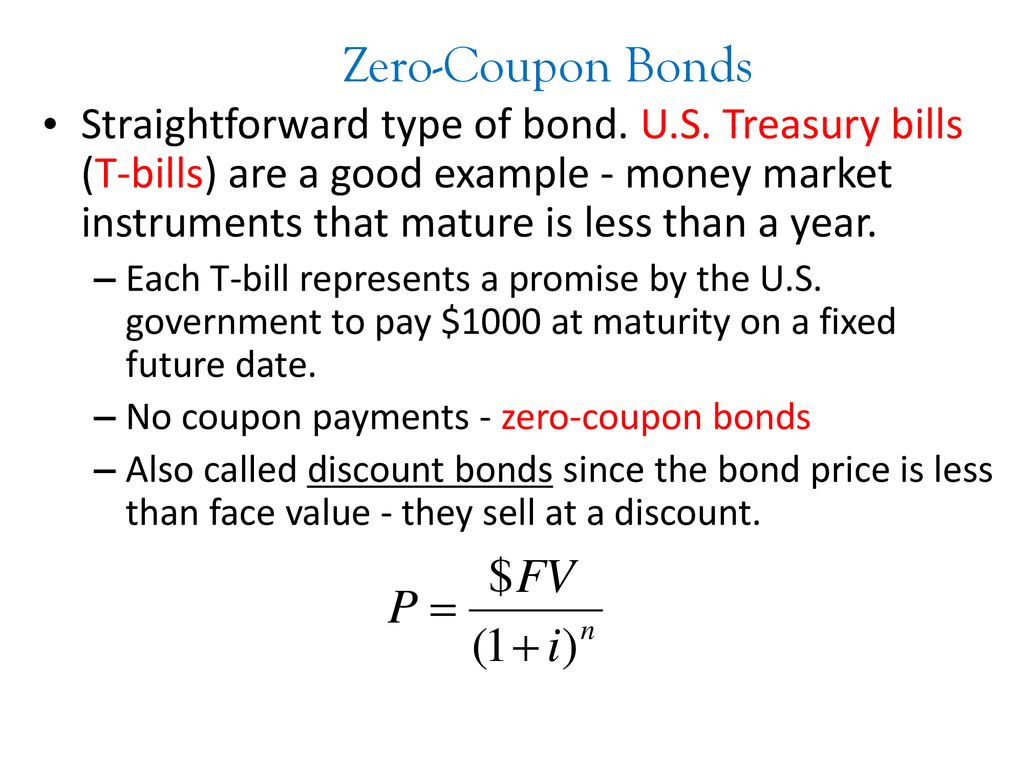

T bill coupon rate. What are coupons in treasury bills/bonds? - Quora Answer (1 of 12): They used to be actual additions to bonds printed on paper, representing the interest due at certain dates, so you could cut them from the bonds and present them for payment by the bond issuer. The nature of these financial instruments is that they generate interest payments at ... Individual - Treasury Bonds: Rates & Terms Premium (price above par) 30-year bond reopening. Issue Date: 9/15/2005. 3.99%. 4.25%. 104.511963. Above par price required to equate to 3.99% yield. Sometimes when you buy a bond, you are charged accrued interest, which is the interest the security earned in the current semiannual interest period before you took possession of the security. US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

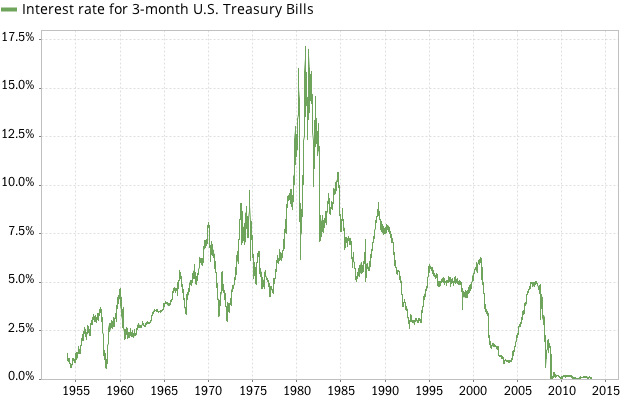

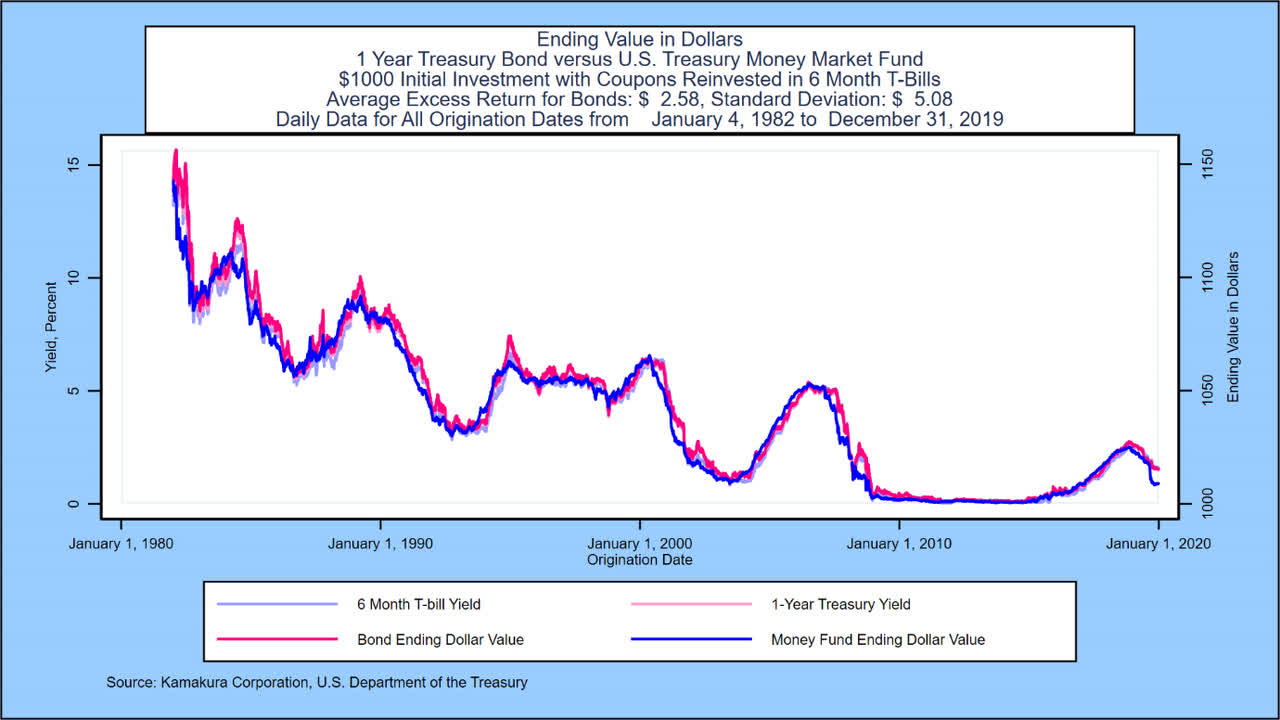

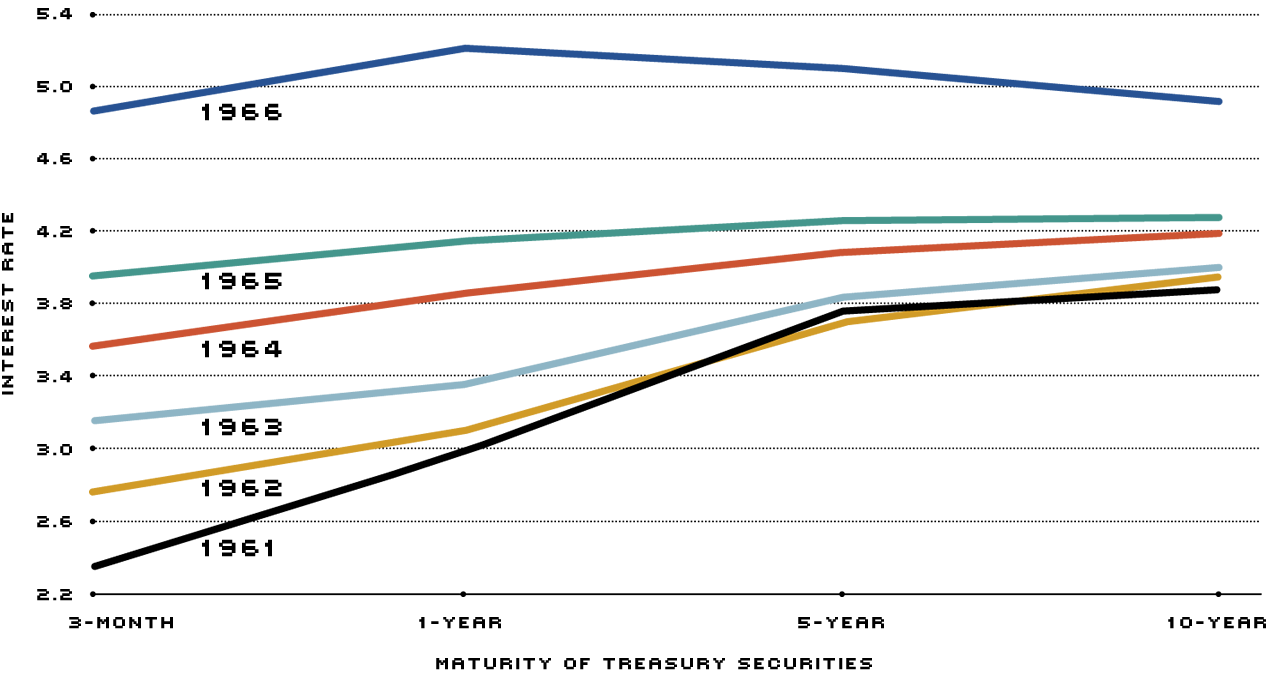

Should You Buy Treasuries? - Forbes The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison, Nerdwallet reports the national average rate on a high-yield savings account is .70%. (Note: both figures are annualized, so... Treasuries - WSJ Treasury Notes & Bonds. Treasury Bills. Treasury note and bond data are representative over-the-counter quotations as of 3pm Eastern time. For notes and bonds callable prior to maturity, yields ... Price, Yield and Rate Calculations for a Treasury Bill Calculate the ... Calculate Coupon Equivalent Yield In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as: a, b, and c. 364 0.25 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one half-year to maturity Personal Finance: Short-Term T-Bill Interest Rates Are Way Up - Bloomberg The shortest-term T-bill lasts just a month and is offering a rate of 2.6%, according to Bloomberg data. Three-month bills are paying 3.2% and one-year bills a generous 4.1%. It was 0.04% on a one ...

AT&T Internet + AT&T Deals | Broadband Plans & Offers Price for internet 300 for new residential customers & is after $5/mo autopay & paperless bill discount. Pricing for first 12 months only. After 12 mos., then prevailing rate applies. $5/mo discount: Must enroll in autopay & paperless bill at point of sale or within 30 days of service activation to receive discount. Must maintain autopay ... Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value ... 13 Week Treasury Bill (^IRX) Historical Data - Yahoo Finance Get historical data for the 13 Week Treasury Bill (^IRX) on Yahoo Finance. View and download daily, weekly or monthly data to help your investment decisions. Resource Center | U.S. Department of the Treasury Daily Treasury Bill Rates. Daily Treasury Long-Term Rates. Daily Treasury Real Long-Term Rates ... COUPON EQUIVALENT 13 WEEKS BANK DISCOUNT COUPON EQUIVALENT 26 WEEKS BANK DISCOUNT COUPON EQUIVALENT 52 WEEKS BANK DISCOUNT COUPON EQUIVALENT 1 Mo 2 Mo 3 Mo 20 Yr 30 Yr; 01/02/2002: N/A : N/A

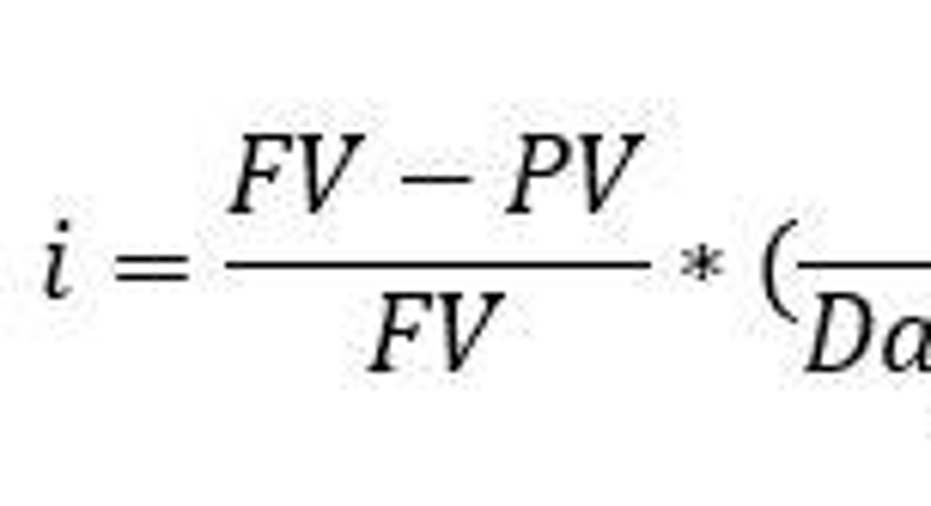

US Treasury Bill Calculator [ T-Bill Calculator ] The annual percentage profit rate based the period of the treasury bill investment The annual interest rate of your T-Bill is calculated for information only. For example, you buy a $5000 T-Bill for $4800 over three months. Your profit is $200, the rate of return is 4.17% Calculations can be saved to a table by clicking the "Add to table" button

Important Differences Between Coupon and Yield to Maturity - The Balance Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch TMUBMUSD01Y | A complete U.S. 1 Year Treasury Bill bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates.

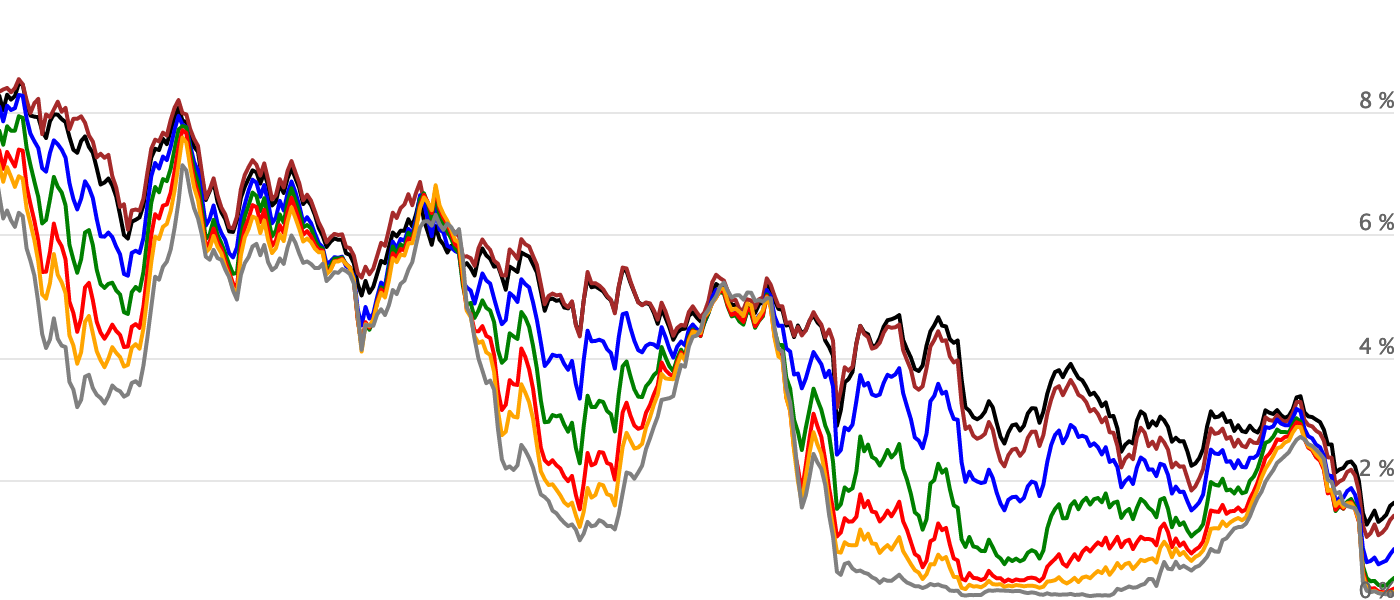

United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year . 0.13: 92.20: 1.93% +121 +362: 2:08 AM:

Our Best Cell Phone Deals & Device Promotions | T-Mobile Contact us before cancelling service to continue remaining bill credits, or credits stop & balance on required finance agreement is due (e.g., OnePlus Nord N10 5G - $299.99 / One Plus Nord N200 5G - $216.00 / T-Mobile REVVL V+ 5G - $199.99 / Moto g play - $150.00 / Moto one 5G ace - $264.00 / Moto g pure - $156.00 / Moto g stylus 5G - $252.00 ...

T-bills: Information for Individuals - Monetary Authority of Singapore What It Is Good For. Use T-bills to: Diversify your investment portfolio. Receive a fixed interest payment at maturity. Invest in a safe, short-term investment option. The price of SGS T-bills may rise or fall before maturity. If you want the flexibility of getting your full investment back in any given month, consider Singapore Savings Bonds ...

13-Week T-Bill Rate Cash (TBY00) - Barchart.com Find the latest 13-Week T-Bill Rate prices and 13-Week T-Bill Rate futures quotes for all active contracts below. Looking for expired contracts? Check out our 13-Week T-Bill Rate Historical Prices page.

T-Mobile & Sprint merged to create America's 5G leader in coverage Savings with T-Mobile 3rd line free via mo. bill credits vs. comparable available plans; plan features and taxes & fees may vary. Credits stop if you cancel any lines. Qualifying new account & credit req'd.

How Are Treasury Bill Interest Rates Determined? - Investopedia For example, suppose an investor purchases a 52-week T-bill with a face value of $1,000. The investor paid $975 upfront. The discount spread is $25. After the investor receives the $1,000 at the...

Advantages and Risks of Zero Coupon Treasury Bonds 31/01/2022 · Persistently high inflation is often accompanied by repeated interest rate hikes, which would cause significant losses for zero-coupon Treasury bonds. On top of that, inflation reduces the value ...

Treasury Bills - Guide to Understanding How T-Bills Work The difference between the face value of the T-bill and the amount that an investor pays is called the discount rate, which is calculated as a percentage. In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills

Your Money: How rate of return on T-Bills is calculated T-bill returns may at times have to be compared with bond market returns. The yield measure that is computed for comparison, depends on whether the bill has less than or more than 182 days till...

What Are Treasury Bills (T-Bills), and Should You Invest ... - SmartAsset Let's say you purchase a $10,000 T-bill with a discount rate of 3% that matures after 52 weeks. That means you pay $9,700 for the T-bill upfront. Once the year is up, you get back your initial investment plus another $300. If you're interested in investing in T-bills, make sure you aren't looking at treasury bonds or treasury notes.

US T-Bill Calculator | Good Calculators Treasury Bills are normally sold in groups of $1000 with a standard period of either 4 weeks, 13 weeks, or 26 weeks. Using our US T-Bill Calculator below you are able to select the face value of your bonds using the drop down list of common values, or you may enter an alternative value that isn't listed in the "Other Value" box.

Solved The annual coupon rate for an inverse floater is (10% | Chegg.com The annual coupon rate for an inverse floater is (10% - T-bill rate) and coupon payments are made annually. The face value of the bond is $1,000,000. Assume that the current T-bill rate for the specific period is 4%. What would be the coupon payment for the inverse floater in this period? Group of answer choices. None. $40,000. $70,000. $60.000 ...

Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

Switch to T-Mobile from Verizon or AT&T & Bring Your Phone Plus, our Price Lock guarantee means that unlike other carriers, we won’t raise the price of your rate plan—and we’ll give you even more great benefits. With 3 lines on Essentials, Magenta, or MAX. Savings with T-Mobile 3rd line free via mo. bill credits vs. comparable available plans; plan features and taxes & fees may vary.

What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia T-bills are short-term government debt instruments with maturities of one year or less, and they are sold at a discount without paying a coupon. T-Notes represent the medium-term maturities of 2,...

Treasury Coupon Issues | U.S. Department of the Treasury Daily Treasury Bill Rates. ... "The Yield Curve for Treasury Nominal Coupon Issues" by James A. Girola - 5/16/2014 "The Treasury Real Yield Curve and Breakeven Inflation" by James A. Girola - 7/21/2015 "Treasury Yield Curves and Discount Rates" by James A. Girola - 2/27/2016

United States Treasury security - Wikipedia Treasury notes ( T-notes) have maturities of 2, 3, 5, 7, or 10 years, have a coupon payment every six months, and are sold in increments of $100. T-note prices are quoted on the secondary market as a percentage of the par value in thirty-seconds of a dollar. Ordinary Treasury notes pay a fixed interest rate that is set at auction.

91 Day T Bill Treasury Rate - Bankrate The yield on 91-day Treasury bills is the average discount rate. How it's used: The rate is used as an index for various variable rate loans, particularly Stafford and PLUS education loans. Lenders...

Discounting - Wikipedia Discounting is a financial mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee. Essentially, the party that owes money in the present purchases the right to delay the payment until some future date. This transaction is based on the fact that most people prefer current interest to delayed interest …

/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

![1. [20 points] You observe the following Treasury | Chegg.com](https://media.cheggcdn.com/media/e27/e270d5a8-78a8-4494-b4e5-34ea83f2212f/php46N91z.png)

:max_bytes(150000):strip_icc()/dotdash_INV_final_Discount_Yield_Jan_2021-01-fc704294a32348a7bc00e0fc7652b88e.jpg)

:max_bytes(150000):strip_icc()/UnderstandingTreasuryYieldAndInterestRates2-81d89039418c4d7cae30984087af4aff.png)

:max_bytes(150000):strip_icc()/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)

Post a Comment for "39 t bill coupon rate"