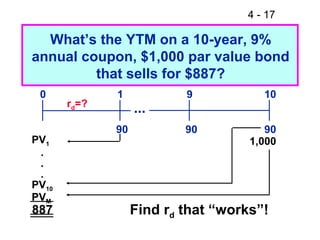

39 a 10 year bond with a 9 annual coupon

Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84 This makes - ogno.killshot.info The price of a bond is $920 with a face value of $1000 which is the face value of many bonds. Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be. After solving this equation, the estimated yield to maturity is 11.25%..

› 2016 › 10-year-treasury-bond10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends 10 Year Treasury Rate - 54 Year Historical Chart. Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of October 20, 2022 is 4.24%.

A 10 year bond with a 9 annual coupon

abcnews.go.com › technologyTechnology and Science News - ABC News Oct 17, 2022 · The Surface Pro 9 is a cross between a laptop and a tablet and has 19 hours of battery life. October 13 Taiwan chipmaker TSMC says quarterly profit $8.8 billion Buying a $1,000 Bond With a Coupon of 10% - Investopedia Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If interest rates change, the price of the bond will fluctuate... A 10 year bond with a 9 percent semiannual coupon is A 10 year bond with a 9 percent semiannual coupon is currently selling at par A from FIN 101 at Austin College. Study Resources. Main Menu; by School; ... A 10 year bond with a 9 percent semiannual coupon is currently selling at par A. A 10 year bond with a 9 percent semiannual coupon is. School Austin College; Course Title FIN 101; Type.

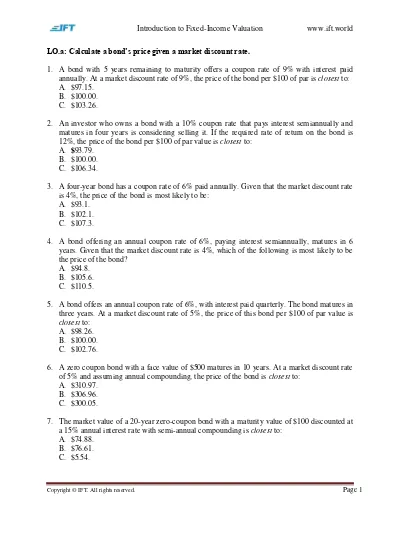

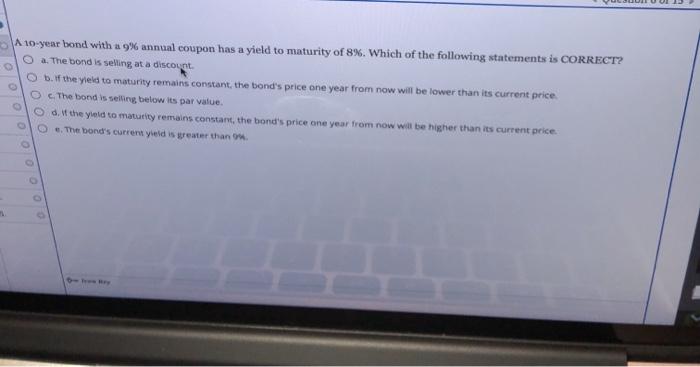

A 10 year bond with a 9 annual coupon. Chapter 7 Finance 310 Flashcards | Quizlet If interest rates decline, the prices of both bonds would increase, but the 10-year bond would have a larger percentage increase in price. Correct Answer: A Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon rate of 9.5%. The bond has a face value of $1,000, and it makes semiannual interest payments. What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg Question: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value b. the bond is selling at a discount c. the bond will earn a rate of return greater than 8% d. the bond is selling at a premium to par value This problem has been solved!

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. If the yield to maturity remains constant, the bond's price one year from now will be higher than its Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). Bond - eaxdal.tomodachi-bg.info Bond's face value (nominal value) which is its book value; Bond's coupon rate (interest rate). The equations that the algorithm is based on are: ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. FINANCE - Module 7 Flashcards | Quizlet 21. A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is NOT CORRECT? A. The bond's expected capital gains yield is positive. B. The bond's yield to maturity is 9%. C. The bond's current yield is 9%. D. If the bond's yield to maturity remains constant, the bond ...

A 10-year bond paying 8% annual coupons pays $1000 at maturity ... - Quora A 10-year bond paying 8% annual coupons pays $1000 at maturity. If the required rate of return on the bond is 7%, then today the bond will sell (rounded to the nearest cent) for what? - Quora Answer (1 of 3): We can use the formula for present value of annuity to calculate this. Also, the above formula consid... › moneyMoney: Personal finance news, advice & information - The ... Oct 23, 2022 · Money Makeover: ‘I earn £150k and don’t have a pension – can I retire in 10 years?’ By Tom Haynes Money Makeover: 'I'm 39 and earn £120,000 – how can I be semi-retired by 55?' A 10 year corporate bond has an annual coupon of 9 A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is INCORRECT? a. The bond's expected capital gains yield is positive. b. The bond's yield to maturity is 9%. c. The bond's current yield is 9%. d. The bond's current yield exceeds its capital gains yield. ANS: A a. a-10-year-bond-with-a-9-percent-annual-coupon-has-a-yield A 10-year bond with a 9 percent annual coupon has a yield to maturity of 8 percent. Which of the following statements is most correct? a. The bond is selling at a discount. b. The bond's current yield is greater than 9 percent. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current ...

A 10 year bond with a 9 annual coupon has a yield to A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b. The bond is selling below its par value.c. The bond is selling at a discount. d.

› createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

home.treasury.gov › policy-issues › financialSanctions Programs and Country Information | U.S. Department ... Oct 19, 2022 · OFAC administers a number of different sanctions programs. The sanctions can be either comprehensive or selective, using the blocking of assets and trade restrictions to accomplish foreign policy and national security goals. Where is OFAC's country list? Active Sanctions Programs: Program Last Updated: Afghanistan-Related Sanctions 02/25/2022 Balkans-Related Sanctions 10/03/2022 Belarus ...

› archiveArchives - Los Angeles Times Nov 23, 2020 · You can also browse by year and month on our historical sitemap. Searching for printed articles and pages (1881 to the present) Readers can search printed pages and article clips going back to ...

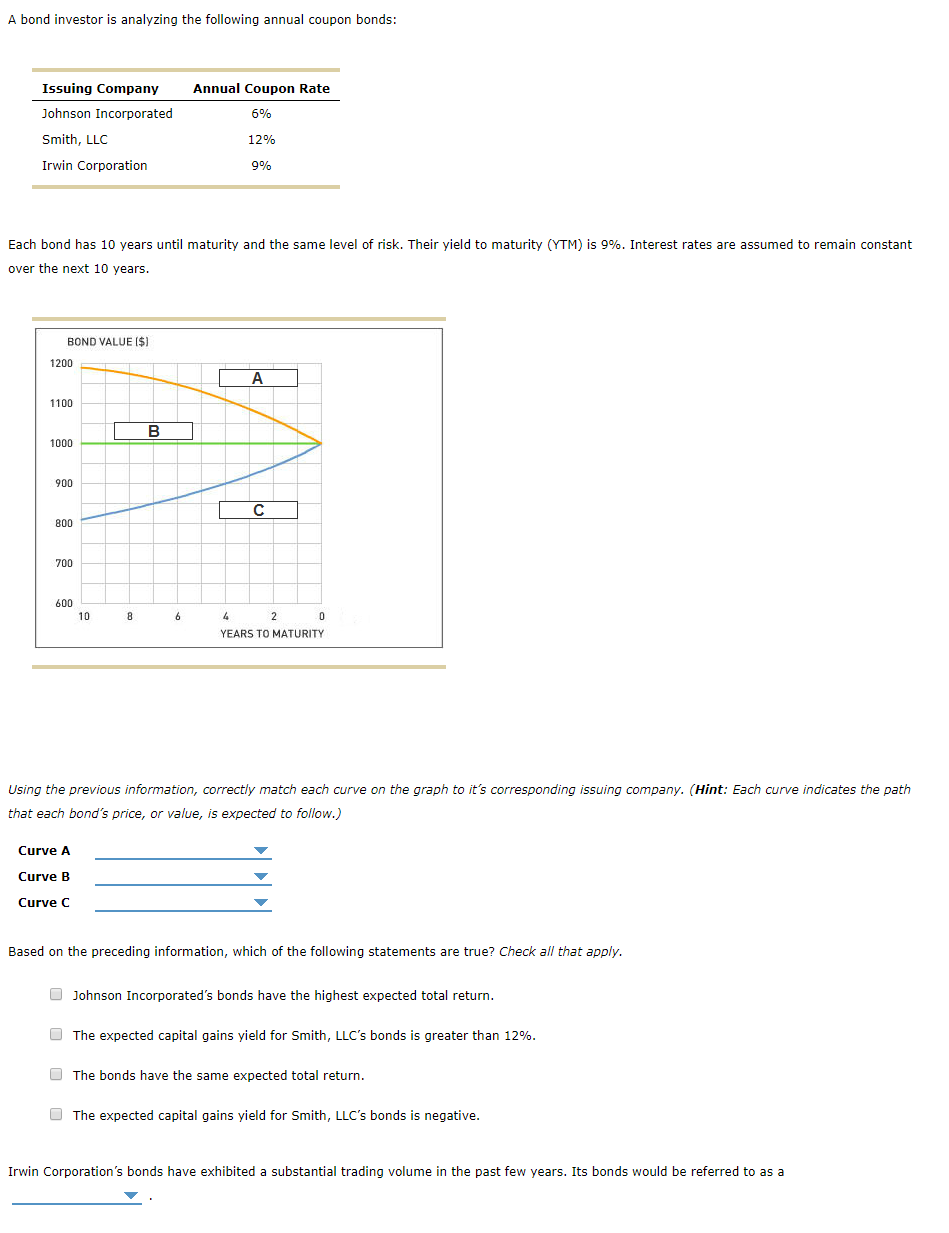

Chapter 7 Homework Finance Flashcards | Quizlet d. The bond's required rate of return is less than 7.5%. e. If the yield to maturity remains constant, the price of the bond will decline over time. e***. Bond A has a 9% annual coupon, while Bond B has a 7% annual coupon. Both bonds have the same maturity, a face value of $1,000, an 8% yield to maturity, and are noncallable.

Answered: A 10-year bond with a 9% annual coupon… | bartleby A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Group of answer choices If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond is selling at a discount.

Bond Yield Calculator | Calculate Bond Returns coupon rate is the annual interest you will receive by investing in the bond, and frequency is the number of times you will receive it in a year. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest annually. Determine the years to maturity; The n is the number ...

A 10-year bond with a 9% annual coupon has a yield to maturity… I have a question: A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from … read more

chapter5practicetest.docx - A 10-year bond with a 9% annual coupon has ... chapter5practicetest.docx - A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Select chapter5practicetest.docx - A 10-year bond with a 9% annual... School Texas State University Course Title FIN 3313 Uploaded By tynupe Pages 6 Ratings 71% (7)

A 10-year bond with a 9% annual coupon has a yield to maturity of 8% ... answered • expert verified A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling below its par value. b. The bond is selling at a discount. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d.

Coupon Bond - Investopedia Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ...

Answered: A 10-year bond with a 9% annual coupon… | bartleby Transcribed Image Text: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%.

FINN 3226 CH. 4 Flashcards | Quizlet A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b.

Finance Flashcards | Quizlet A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. The bond's current yield is greater than 9%. c.

› 10-year-treasury-note10-Year Treasury Note and How It Works - The Balance Mar 24, 2022 · It's easy to confuse the fixed annual interest rate—the "coupon yield"—with the "yield to maturity" quoted daily on the 10-year treasury. Many people refer to the yield as the Treasury Rate. When people say "the 10-year Treasury rate," they don't always mean the fixed interest rate paid throughout the life of the note. They often mean the ...

What is the value of a 10-year, $1,000 par value bond with a 10 ... - Quora Answer (1 of 2): The required rate of return on a bond is the interest rate that a bond issuer offers to get investors interested. I think you probably meant the yield to maturity instead. In any case, if a fixed-rate bond with no special features has the annual coupon equal the yield, its value ...

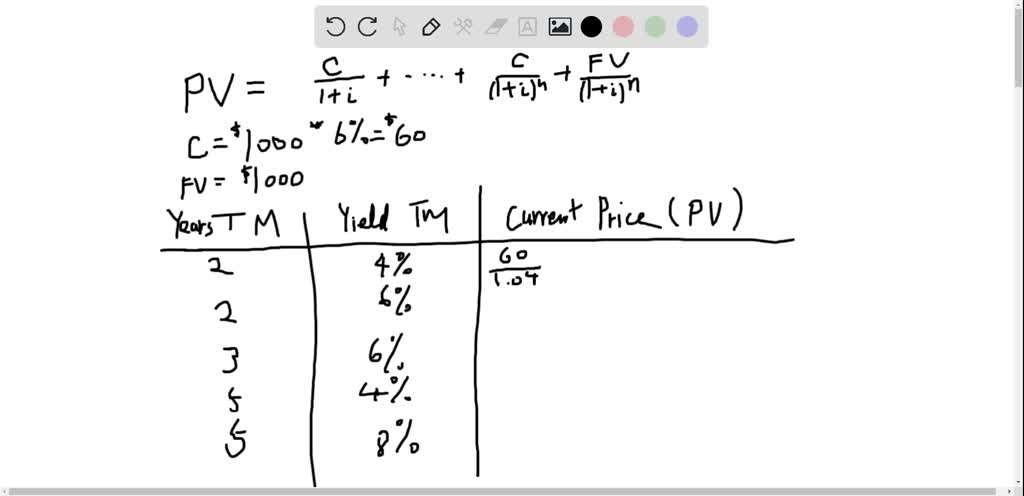

A 10 year bond with a face value of 1000 has a coupon A 10-year bond with a face value of $1000 has a coupon rate of 5.8%, with semiannual payments. With the above information, please answer questions 8 - 9. 8. What is the coupon payment of this bond? A. $1000 B. $580 C. $58 D. $29.

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd.

A 10 year bond with a 9 percent semiannual coupon is A 10 year bond with a 9 percent semiannual coupon is currently selling at par A from FIN 101 at Austin College. Study Resources. Main Menu; by School; ... A 10 year bond with a 9 percent semiannual coupon is currently selling at par A. A 10 year bond with a 9 percent semiannual coupon is. School Austin College; Course Title FIN 101; Type.

Buying a $1,000 Bond With a Coupon of 10% - Investopedia Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If interest rates change, the price of the bond will fluctuate...

abcnews.go.com › technologyTechnology and Science News - ABC News Oct 17, 2022 · The Surface Pro 9 is a cross between a laptop and a tablet and has 19 hours of battery life. October 13 Taiwan chipmaker TSMC says quarterly profit $8.8 billion

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "39 a 10 year bond with a 9 annual coupon"