38 what is coupon payment of a bond

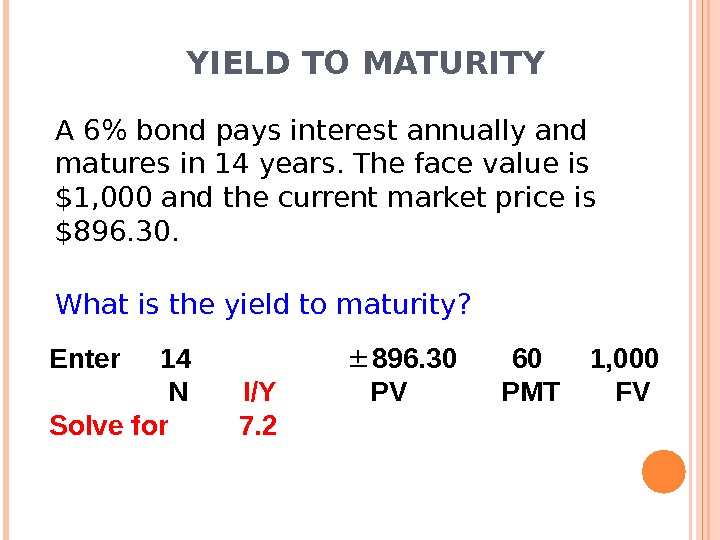

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers. Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.

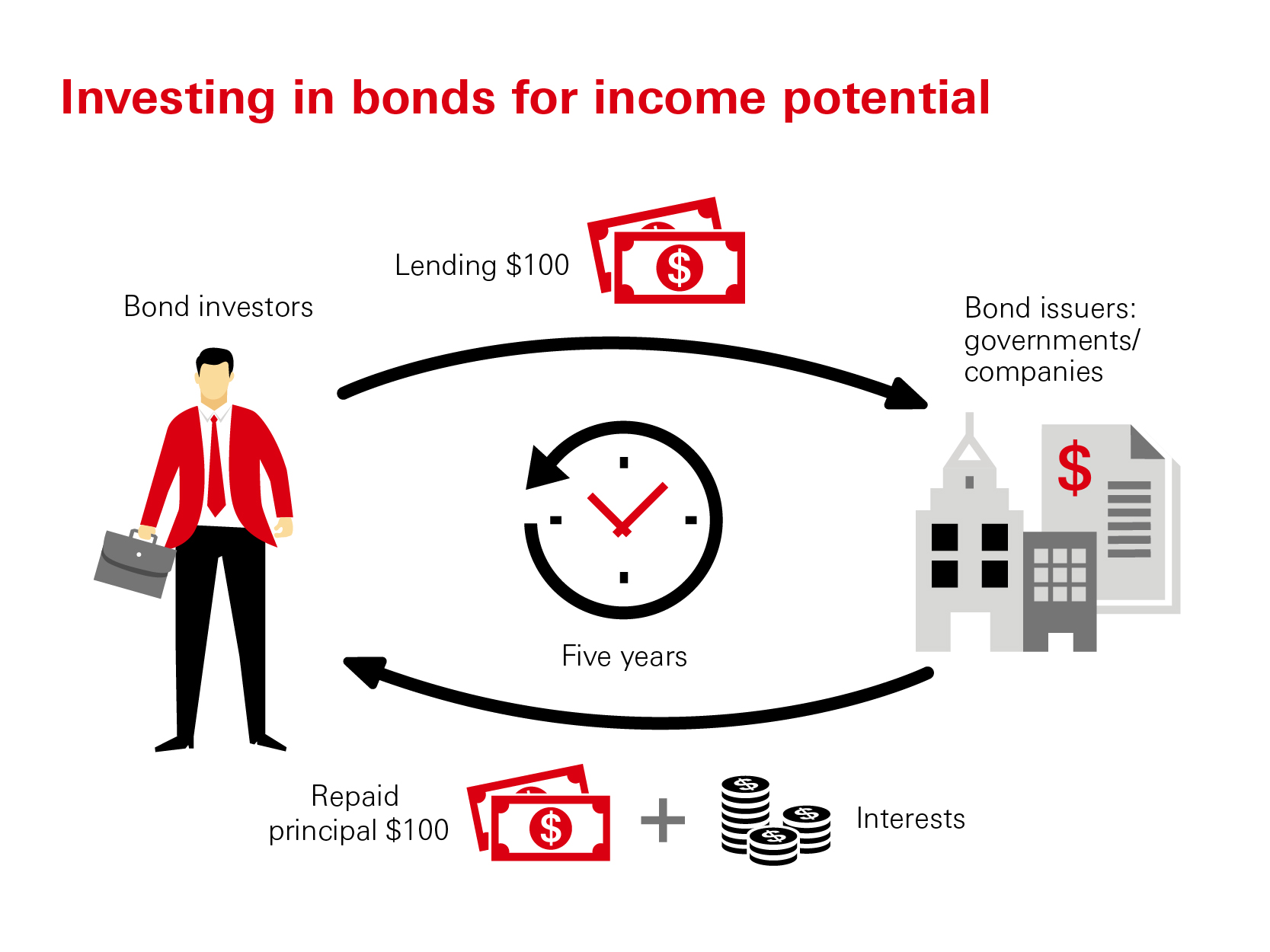

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

What is coupon payment of a bond

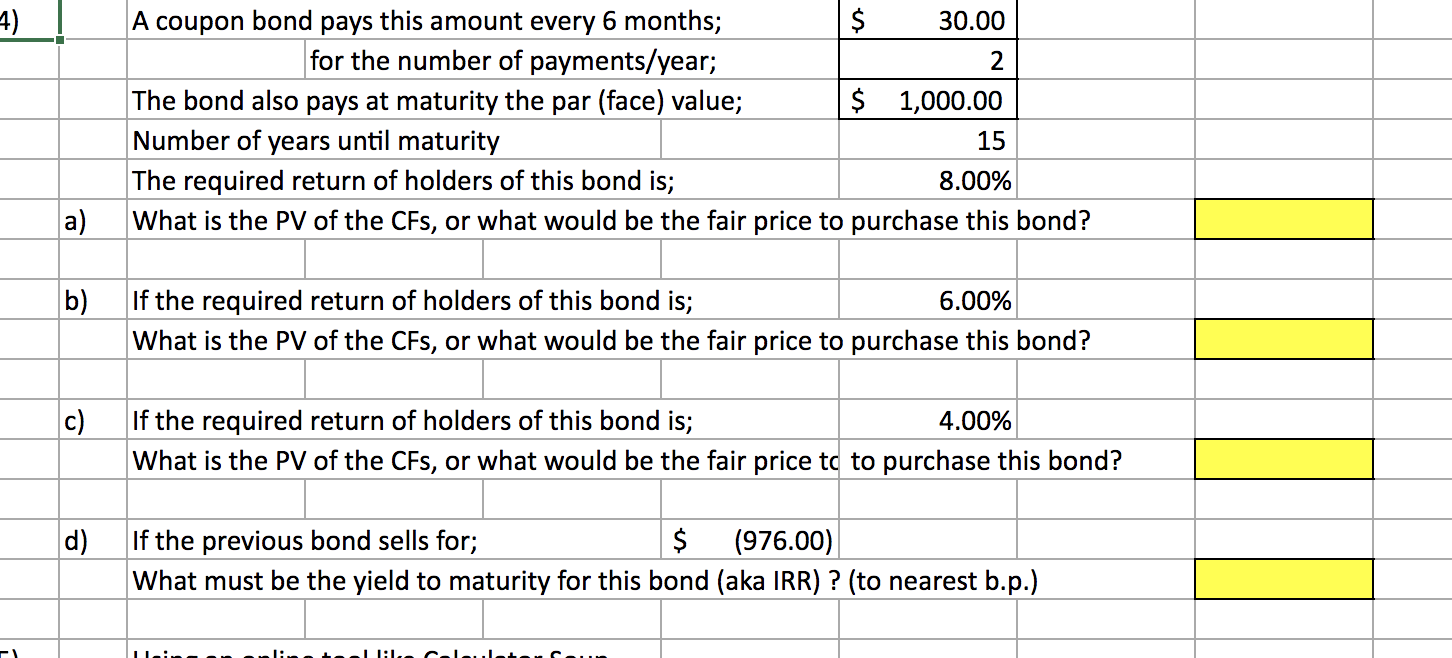

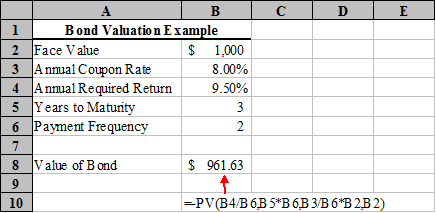

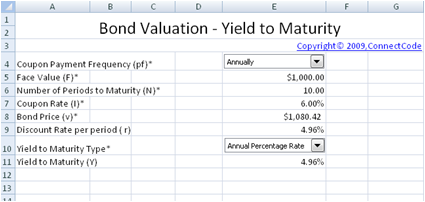

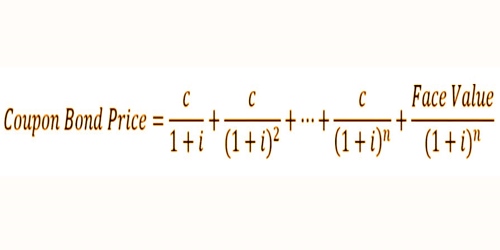

How to Calculate a Coupon Payment: 7 Steps (with Pictures) Since bondholders generally receive their coupon payments semiannually, you just divide the annual coupon payment by two to receive the actual coupon payment. For example, if the annual coupon payment is $80, then the actual coupon payment is $80/2 or $40. Tips The calculations above will work equally well when expressed in other currencies. Coupon Rate Calculator | Bond Coupon A coupon is the interest payment of a bond. Typically, it is distributed annually or semi-annually depending on the bond. We usually calculate it as the product of the coupon rate and the face value of the bond. How often do I receive coupons from investing in bonds? The short answer is it depends on the bonds that you invest in. Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ...

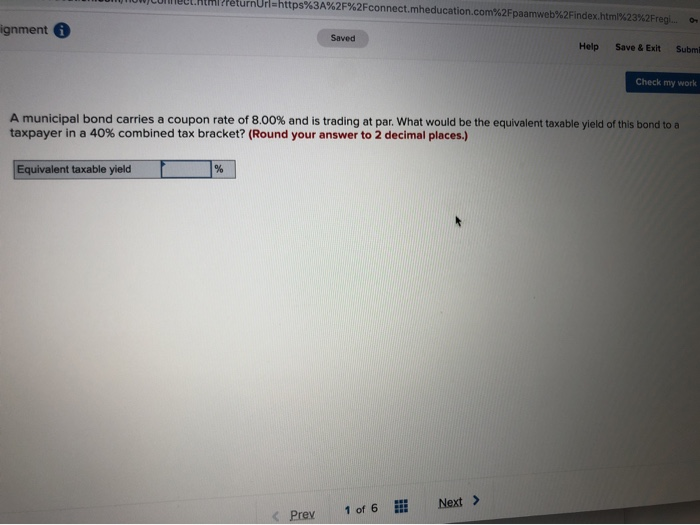

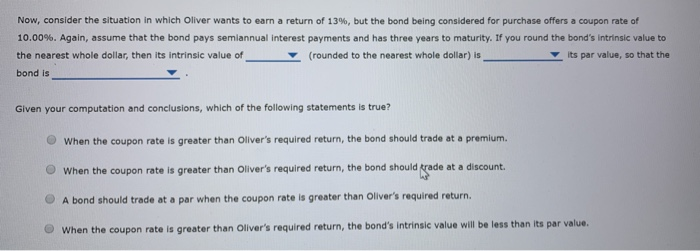

What is coupon payment of a bond. What is Coupon payment | Capital.com It's the annual interest payment made by the issuer of a bond to the bondholder until it reaches maturity. The coupon payment - or simply coupon is expressed as a percentage of the bond's value at the time it was issued. Where have you heard about coupon payment? The term coupon comes from once popular bearer bond certificates. Coupon Bond - Definition, Terminologies, Why Invest? The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate, which is determined by multiplying the coupon rate by the bond's nominal value and the period factor. For example, if you own a bond with a face value of $1,000 and an annual coupon rate of 5%, your annual interest payment will be $5. What Is a Coupon Rate? And How Does It Affects the Price of a Bond? The coupon rate is also called coupon payment. It is the yield the bond paid on its issue date. The yield changes when the value of the bond changes. Such a case results in giving the bond's yield to maturity. In the case of the booming market, the coupon holder yields lesser than the prevailing market conditions as bonds won't pay more. ... What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Bond Prices: Annual Vs. Semiannual Payments | Pocketsense Payment frequency mainly affects interest compounding. The more frequent a bond pays its coupon payments, the higher the effective yield of the bond under the same annual coupon rate. If a bond pays coupon interest semiannually instead of annually, it will compound interest twice rather than once, increasing total bond returns at the end of a year. What Are Coupon Payments? - ClydeBank Media Coupon payment is the periodic payment of interest by a bond issuer to a bondholder. Coupon payment is not to be confused with stock dividend payment—the two are distinct in a few ways. When an investor or trader purchases shares of stock in a company, they are purchasing the rights to a portion of that company's profits. What Is Coupon Rate and How Do You Calculate It? What Is Coupon Rate and How Do You Calculate It? Bond coupon rate dictates the interest income a bond will pay annually. We explain how to calculate this rate, and how it affects bond prices. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

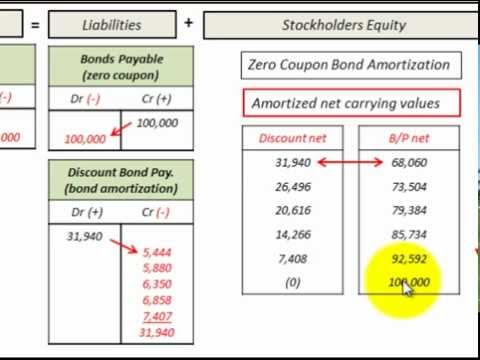

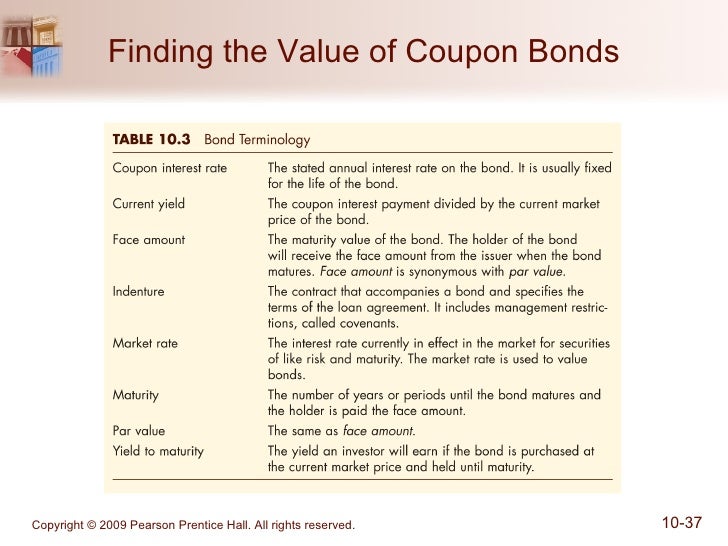

What is a Coupon Bond? - Definition | Meaning | Example Definition: A coupon bond is a debt instrument that has detachable slips of paper that can be removed from the bond contract itself and brought to a bank or broker for interest payments. These detachable slips of paper are called coupons and represent the interest payments due to the bondholder. Each coupon has its maturity date printed on it. Coupon Bond - Investopedia A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of... Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond . Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. How to Calculate an Interest Payment on a Bond: 8 Steps Since a bond's yield is the coupon payment as a percent of its current value, the coupon ($50) would be 10% of the current value ($500). As bond prices drop the percent yield goes up. The reason bond market prices change is due to fluctuations in the market. For example, if long term interest rates rise from 5% (the coupon rate also) when the ...

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms...

What is a Coupon Rate? | Bond Investing | Investment U Most bonds pay out coupons on a semi-annual basis, relative to the par (face) value of the bond. It's a representation of how much the issuer will pay to borrow money, as well as how valuable the bond will be to investors over its life. The bond's coupon rate is especially important when considering bonds as fixed-income investments.

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

How Are Bond Prices Affected by Coupon Payment Dates? You are buying the bond on the 122nd day of a payment period that has 184 days. The seller is therefore entitled to 121/184 of the Feb. 15, 2000, coupon payment. A quick calculation shows that ...

What is a Coupon Payment? - Definition | Meaning | Example What is the definition of coupon payment? Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond.

What Is a Coupon Payment? - Smart Capital Mind A coupon payment is a payment made to the holder of a bond for the interest that bond accrues while it is maturing. This is typically made as a semi-annual payment, so only half of the interest owed on the bond is paid at a time.

Coupon Bond Formula | Examples with Excel Template The coupon payment is the product of the coupon rate and the par value of the bond. It also does not change over the course of the bond tenure. The annual coupon payment is denoted by C and mathematically represented as shown below. C = Annual Coupon Rate * F

Solved What is the coupon payment of a bond with a face | Chegg.com What is the coupon payment of a bond with a face value of $1,000 and an annual interest rate of 4%? Coupon payment is equal to $ (Enter your response as an integer.) Question : What is the coupon payment of a bond with a face value of $1,000 and an annual interest rate of 4%?

Coupon Bond Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying you $50 per year. To claim your interest payment, you would simply clip off the ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. Government and non-government entities issue bonds to raise money to finance their operations.

Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ...

Coupon Rate Calculator | Bond Coupon A coupon is the interest payment of a bond. Typically, it is distributed annually or semi-annually depending on the bond. We usually calculate it as the product of the coupon rate and the face value of the bond. How often do I receive coupons from investing in bonds? The short answer is it depends on the bonds that you invest in.

How to Calculate a Coupon Payment: 7 Steps (with Pictures) Since bondholders generally receive their coupon payments semiannually, you just divide the annual coupon payment by two to receive the actual coupon payment. For example, if the annual coupon payment is $80, then the actual coupon payment is $80/2 or $40. Tips The calculations above will work equally well when expressed in other currencies.

Post a Comment for "38 what is coupon payment of a bond"