43 zero coupon bonds formula

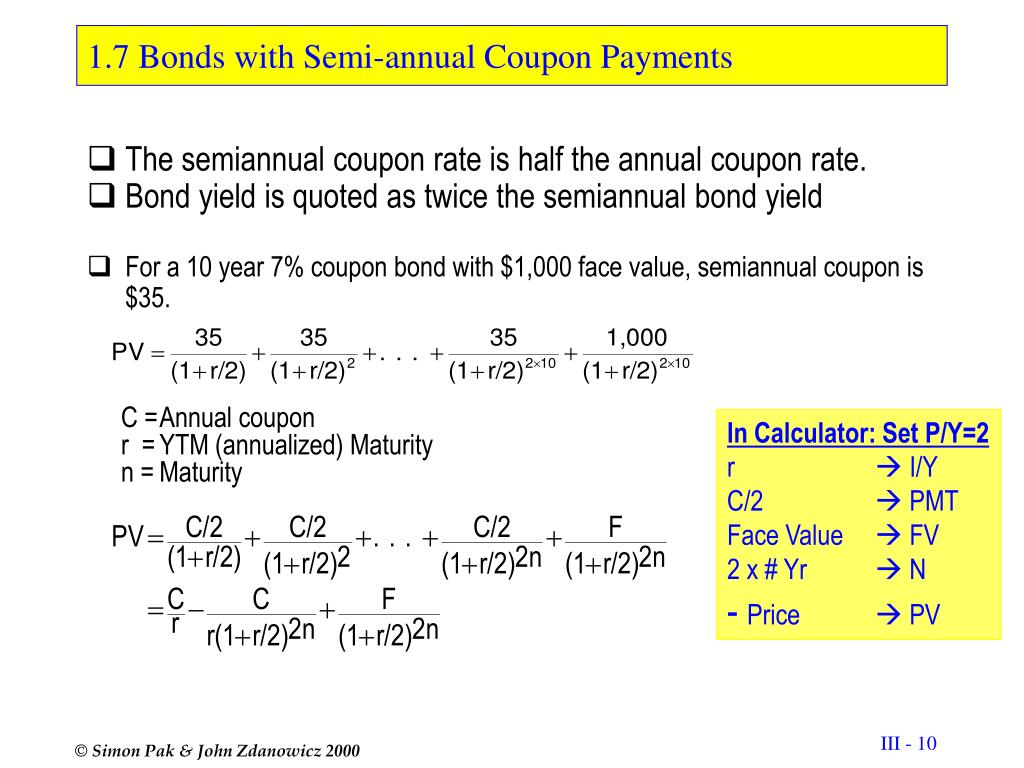

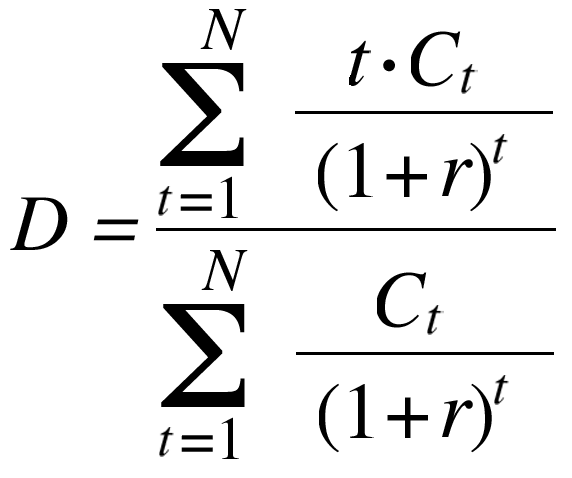

Coupon Bond Formula | Examples with Excel Template Coupon Bond Formula - Example #1. Let us take the example of some coupon paying bonds issued by DAC Ltd. One year back, the company had raised $50,000 by issuing 50,000 bonds worth $1,000 each. The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity. Macaulay's Duration | Formula | Example The duration of a coupon-paying bond can be calculated by considering each cash flow as a separate zero-coupon bond. Formula The maturity (in years) of each cash flow of a coupon bond is weighted based on the proportion of the present value of the cash flow to the total present value of all cash flows.

Zero Coupon Bond Value Formula: How to Calculate Value of ... Example of price of a zero-coupon bond calculation Let's assume an investor wants to make 10% of return on a bond. The face value of the bond is $10,000. The bond is redeemed in 5 years. What price the investor would pay for this bond? M = $10,000 r = 10% n = 5 katex is not defined

Zero coupon bonds formula

Bond Formula | How to Calculate a Bond | Examples with ... Coupon Bond Price = C * [ (1- (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t] where, C = Annual Coupon Payment F = Par Value at Maturity r = YTM n = Number of Coupon Payments in A Year t = Number of Years until Maturity On the other hand, the formula for zero-coupon bond (putting C = 0 in the above formula) is represented as, Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value =Maturity Value/ (1+i)^ Number of Years You are free to use this image on your website, templates etc, Please provide us with an attribution link Example Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. Zero Coupon Bond | Definition, Formula & Examples - Video ... Zero-Coupon Bond Formula: Zero-coupon bonds are real-life applications of the time value of money concept which underlines that $100 now is worth more than $100 in the future.

Zero coupon bonds formula. Zero Coupon Bond Value - Formula (with Calculator) Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Example Zero-coupon Bond Formula P = M / (1+r)n variable definitions: P = price M = maturity value r = annual yield divided by 2 n = years until maturity times 2 The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. How to Calculate a Zero Coupon Bond Price | Double Entry ... Suppose the discount rate was 7%, the face value of the bond of 1,000 is received in 3 years time at the maturity date, and the present value is calculated using the zero coupon bond formula which is the same as the present value of a lump sum formula. The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond ... Coupon Bond Formula | How to Calculate the Price of Coupon ... Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

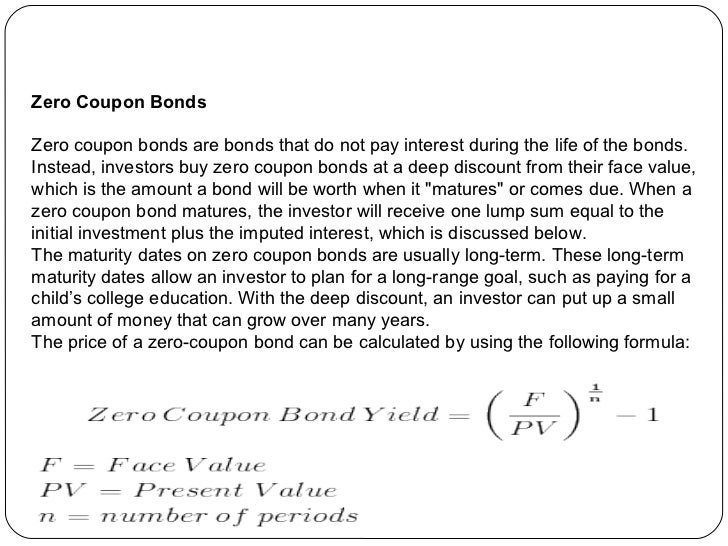

Zero Coupon Bond Calculator - What is the Market Price ... Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000. Interest Rate: 10%. Time to Maturity: 10 Years, 0 Months. Substituting into the formula: P ( 1 + r) t = 1 0 0 0 ( 1 +. Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top Zero Coupon Bond Yield: Formula, Considerations, and ... The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... How to Calculate the Yield of a Zero Coupon Bond Using ... That's gonna allow us to calculate just that so let's jump into an example and I'll show you how it works. So let's say that you didn't know the yield on a five-year zero-coupon bond but you did know the forward rates here I've got the forward rates for the next five years so you've got these different forward rates here and you can essentially just plug them into this formula above and we can ...

Zero-Coupon Bond Definition - Investopedia If the debtor accepts this offer, the bond will be sold to the investor at $20,991 / $25,000 = 84% of the face value. Upon maturity, the investor gains $25,000 - $20,991 = $4,009, which translates... Deep Discount Bond or Zero Coupon Bond - CommerceAngadi.com It is called a Deep Discount bond or Zero Coupon Bond. The difference between the Maturity amount received and the purchase price is an Income to this type of Bondholder. A Bond is issued for ₹ 730 with a maturity amount of ₹ 1,000 at the end of 5 years. It means purchases purchase this bond at ₹ 730 (at discount) & will get ₹ 1,000 at ... Zero Coupon Bond Yield Calculator - Find Formula, Example ... Zero Coupon Bond Yield Calculator Formula. Let us go on with the formula again after the example, for clearer perspective. The other time value of money formulas needs an interest rate from each period of the investment. This is why finding the yield for the zero coupon bond is essentially easy, for all the investors need to take into account ... How to calculate bond price in Excel? - ExtendOffice In this condition, you can calculate the price of the semi-annual coupon bond as follows: Select the cell you will place the calculated price at, type the formula =PV (B20/2,B22,B19*B23/2,B19), and press the Enter key. Note: In above formula, B20 is the annual interest rate, B22 is the number of actual periods, B19*B23/2 gets the coupon, B19 is ...

Zero Coupon Bond: Definition, Formula & Example - Video ... The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i )^ n where: M = maturity value or face value i =...

Zero-Coupon Bond Value | Formula, Example, Analysis ... Zero-Coupon Bond Value Formula Price = \dfrac {M} { (1 + r)^ {n}} Price = (1+r)nM M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity Face Value is equivalent to the bond's future or maturity value. The formula above applies when zero-coupon bonds are compounded annually.

Zero-Coupon Bonds: Definition, Formula, Example ... The price of zero-coupon bonds is calculated using the formula given below: See also Derivative Instruments - All You Need to Know Price = M / (1 + r) ^ n, where M = maturity value of the bond. (In other words, the face value of the bond) R = required rate of return (or interest rate) N = number of years till maturity

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05/2) 5*2 = $781.20 The price that John will pay for the bond today is $781.20. Reinvestment Risk and Interest Rate Risk Reinvestment risk is the risk that an investor will be unable to reinvest a bond's cash flows (coupon payments) at a rate equal to the investment's required rate of return.

Zero-Coupon Bond: Formula and Excel Calculator Zero-Coupon Bond Value Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods Zero-Coupon Bond Yield-to-Maturity (YTM) Formula

Zero-Coupon Bond: Definition, Formula, Example etc ... Price of bond = $1,000/ (1+.07)5 = $713.27 Hence, the price that Robi will pay for the bond today is $713.27. Example 2: Semi-annual Compounding Robi is intending to purchase a zero coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 7% compounded semi-annually.

Global Edge International Consulting Associates, Inc.: Investment Protection Using A Zero-Coupon ...

Zero Coupon Bond | Definition, Formula & Examples - Video ... Zero-Coupon Bond Formula: Zero-coupon bonds are real-life applications of the time value of money concept which underlines that $100 now is worth more than $100 in the future.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value =Maturity Value/ (1+i)^ Number of Years You are free to use this image on your website, templates etc, Please provide us with an attribution link Example Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond.

Bond Formula | How to Calculate a Bond | Examples with ... Coupon Bond Price = C * [ (1- (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t] where, C = Annual Coupon Payment F = Par Value at Maturity r = YTM n = Number of Coupon Payments in A Year t = Number of Years until Maturity On the other hand, the formula for zero-coupon bond (putting C = 0 in the above formula) is represented as,

Post a Comment for "43 zero coupon bonds formula"